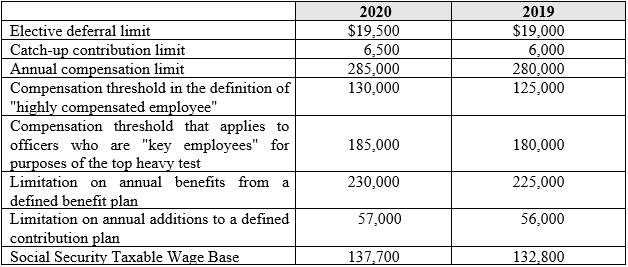

The IRS has announced the annual limits that will apply to qualified retirement plans in 2020. The key 2020 limits, as compared to the 2019 limits, are:

For 401(k) plans, the maximum deferral limit increases by $500 to $19,500 for a participant who is under age 50. A participant who is age 50 or older will be able to defer a maximum of $26,000 ($19,500 + $6,500 catch-up), a $1,000 increase from 2019.

If you have any questions or would like more information, please contact Cynthia A. Moore in the Troy, Michigan office at 248-433-7295.